The finance industry spans continents, systems, and markets, which makes it a compelling field for students who think globally. Careers in finance are not only well-paid, but they also offer pathways into international financial hubs, cross-border transactions, global economic flows, and digital innovation. According to the US Bureau of Labor Statistics, employment in business and financial occupations is projected to grow faster than average, with about 942,500 openings each year globally (through the US data) and a median annual wage of US $80,920 in 2024 for this group.

With a degree in international business, economics, or finance, you can position yourself for roles not only in your home country but also across international financial centers. This will allow you to leverage global financial markets and your international business acumen.

Why Choose a Career in Finance?

As noted in several surveys, finance professionals enjoy a stable career and high earning potential with above-average salaries. For example, median salaries for financial analysts in the US reached over $101,350 in 2024 (Source: U.S. Bureau of Labor Statistics).

While traditional finance roles such as corporate finance and investment banking are still relevant, the rise of global fintech, sustainable finance, and digital platforms means you can also explore emerging fields and work across borders, across time zones, and in innovation-led contexts.

Top 10 High-Paying Careers in the Finance Industry

Finance roles, because of their niche skills and necessity, no matter the position or industry in the market, command high compensation and have strong global relevance. Learning about the top roles in the industry will help you determine how you want to shape or see in real-time how your career path might unfold.

1. Investment Banker:

Investment bankers advise companies and governments in major financial centers on raising capital, restructuring, and cross-border deals.

- Level: Mid to Senior

- Education/Certification: Bachelor's in finance/economics/international business; often MBA or other advanced finance qualification

- Experience (Years): 3-7 years to reach meaningful deal leadership

- Average Base Salary: US $114,535 (Source: Indeed)

2. Financial Analyst

Financial analysts evaluate investment opportunities, assess corporate performance, and forecast global market trends for institutions or investment firms.

- Level: Entry to Mid

- Education/Certification: Bachelor’s in finance or economics; CFA certification beneficial.

- Experience (Years): 0-3 years (entry), 3-5 years (senior)

- Average Base Salary: US $81,548 (Source: Indeed)

3. Portfolio Manager

Portfolio managers oversee large sums in global markets, craft investment strategies, and often work in major financial hubs.

- Level: Senior.

- Education/Certification: Bachelor’s; often Master’s or CFA, strong quantitative background.

- Experience (Years): 5-10 years or more

- Average Base Salary: US $101,846 (Source: Indeed)

4. Risk Manager

Risk managers identify and mitigate financial exposure related to credit, market, and operational factors, ensuring regulatory and global compliance.

- Level: Mid to Senior

- Education/Certification: Bachelor’s in finance, economics, or mathematics; FRM or PRM certification valued

- Experience (Years): 3-8 years

- Average Base Salary: US $113,441 (Source: Indeed)

5. Private Equity Associate

Private equity associates evaluate investment targets, conduct due diligence, and manage private company portfolios for high-return funds.

- Level: Entry to Mid

- Education/Certification: Bachelor’s in finance or economics; MBA or strong modelling skills preferred

- Experience (Years): 2-5 years

- Average Base Salary: US $91,801 (Source: Indeed)

6. Actuary

Actuaries use statistics, mathematics, and financial theory to assess and price risk for insurance, pensions, and corporate finance strategies.

- Level: Mid

- Education/Certification: Bachelor’s in actuarial science, mathematics, or statistics; professional actuarial exams required

- Experience (Years): 3-6 years

- Average Base Salary: US $128,378 (Source: Indeed)

7. Chief Financial Officer (CFO)

CFOs lead corporate financial strategy, manage reporting, budgeting, and long-term planning, often across multinational operations.

- Level: Executive

- Education/Certification: Bachelor’s in finance or accounting; MBA or CPA/CFA advantageous

- Experience (Years): 10-15 years

- Average Base Salary: US $165,842 (Source: Indeed)

8. Financial Planner

Financial planners help individuals manage assets, retirement plans, and investment strategies, often with globally mobile or cross-border clients.

- Level: Entry to Mid

- Education/Certification: Bachelor’s in finance or economics; CFP or similar certification

- Experience (Years): 1-7 years

- Average Base Salary: US $86,659 (Source: Indeed)

9. Quantitative Analyst (Quant)

Quants apply mathematics, algorithms, and data models to forecast markets and design automated trading strategies across global exchanges.

- Level: Mid to Senior

- Education/Certification: Bachelor’s or higher in mathematics, statistics, physics, or computer science; master’s/PhD preferred

- Experience (Years): 2-6 years

- Average Base Salary: US $141,417 (Source: Indeed)

10. Fintech Product Manager

Fintech product managers bridge finance and technology, leading digital banking, blockchain, and payment innovation projects across international markets.

- Level: Mid

- Education/Certification: Bachelor’s in finance, technology, or international business; MBA or product management certification helpful

- Experience (Years): 3-7 years

- Average Base Salary: US $145,000 (Source: levels.fyi)

Skills You Need to Succeed in Finance

A successful career in finance is not guaranteed by a degree. Along with developing theoretical knowledge and internationally recognized laws, you will also need to develop a wide range of practical skills.

- Analytical Thinking and Quantitative Skills: Mastery of financial modelling, economics, statistics, and data analytics.

- Communication and Presentation: Explaining complex financial ideas to global stakeholders, clients, and teams.

- Technology Literacy: With fintech, automation, and digital finance rising, professionals skilled in data analytics, programming, or ERP systems are in increasing demand.

- Cross-cultural Understanding and Global Mindset: Awareness of global financial markets, regulatory differences, cultural nuances, and international business strategy.

Educational Pathways for a Global Finance Career

A successful career in finance starts with the right academic foundation. You must find degrees that blend technical knowledge with international exposure and cross-cultural understanding.

Undergraduate Level

A bachelor’s degree will allow you to build the foundation for quantitative skills and prepare you for global markets and high-paying finance roles.

Graduate Level

Many high-level positions are enhanced by a master’s degree. Graduates from such programs report strong outcomes. Explore Schiller's MSc in Global Finance to explore international finance careers across borders and sectors.

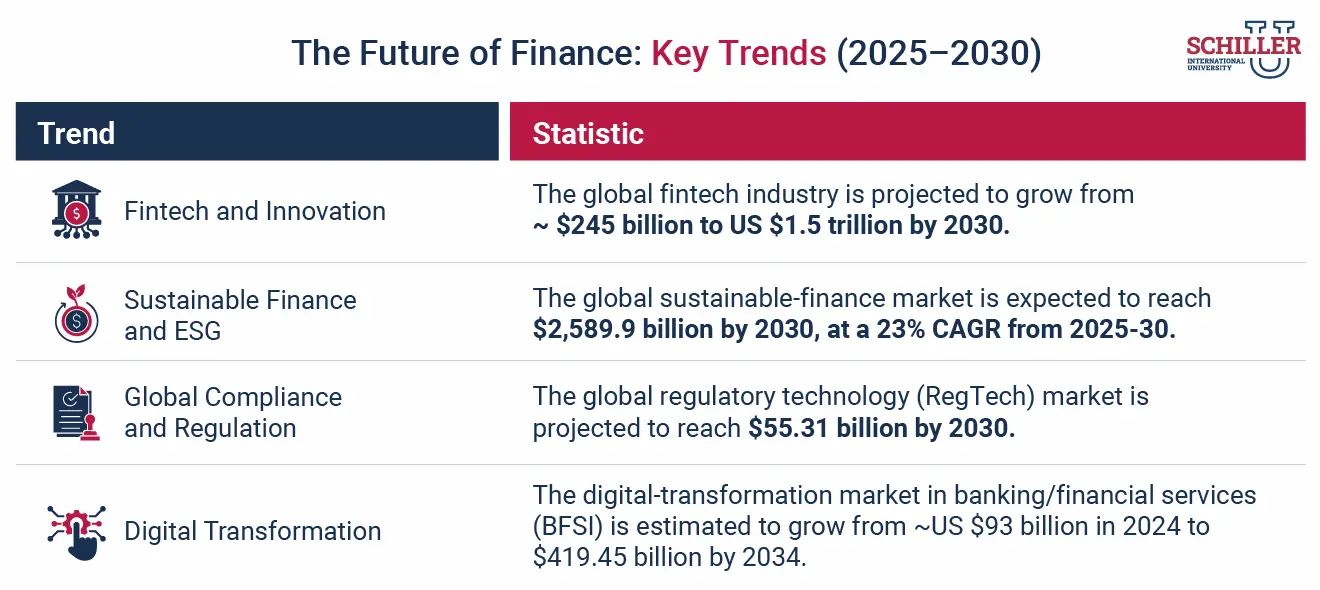

The Future of Finance: Emerging Trends

The technological shifts, sustainability practices, and international regulations are forcing the finance industry to evolve and adapt. This industrial revolution is also transforming global finance careers.

- Fintech and Innovation: Blockchain, digital assets, robo-advisors, and online platforms are redefining financial services.

- Sustainable Finance and ESG: Environmental and social criteria now drive major investment decisions, creating demand for professionals skilled in sustainable finance.

- Global Compliance and Regulation: With growing cross-border trade and investment, knowledge of anti-money-laundering and international tax frameworks is critical.

- Digital Transformation: AI, real-time analytics, and cloud-based systems are reshaping operations. Professionals combining finance and technology will have global mobility and growth potential.

Building a Rewarding Finance Career

The finance industry offers some of the most high-paying finance jobs available globally, from investment banking and portfolio management to fintech product leadership and global risk management. If you want to build a robust international career, choosing a program with an international curriculum and global orientation is the first step.

Explore Schiller's MSc in Global Finance to build strong quantitative skills, gain exposure to international business, and develop your global mindset to work in global financial hubs and markets.

FAQs

Q1. What are the highest paying jobs in the finance industry?

Answer: High-paying finance careers include roles such as investment banker, portfolio manager, CFO, quantitative analyst, and fintech product manager.

Q2. What degree is best for a career in finance?

Answer: A finance degree with a focus on building holistic knowledge and skills in economics, international accounting standards and practices, and audit is especially powerful.

Q3. Are finance jobs in demand internationally?

Answer: Yes. For example, roles such as financial analysts are projected to grow 6 % from 2024 to 2034 in the US, and demand is strong in international hubs as emerging markets expand. Further, cross-border finance, fintech, and global risk roles are increasingly international in scope.

Q4. What skills are most important for success in finance careers?

Answer: Analytical and quantitative capabilities, communication and presentation skills, technology literacy (eg, data analytics, programming), and a global mindset (cultural awareness, language skills, cross-border understanding) are essential for a successful career in finance.

Q5. Can I work abroad with a finance degree from an international university?

Answer: Absolutely. A degree from an internationally oriented university such as Schiller can position you for work in global finance centers, cross-border firms, and international roles, especially when your curriculum includes global finance, international business exposure, and career-oriented training.

Request information

Request information